Joe Ricciuti on the Discovering Commercial Real Estate Podcast

Discover Managing Partner Joe Ricciuti's Commercial Real Estate journey in this insightful YouTube video. Don't miss this inspiring showcase!

Discover Managing Partner Joe Ricciuti's Commercial Real Estate journey in this insightful YouTube video. Don't miss this inspiring showcase!

In September of 2022, I had the opportunity to acquire a Sherwin-Williams property located in St. Johnsbury, VT.

Earlier this year, I had the opportunity to lead the acquisition of a Sherwin-Williams property located in Plattsburgh, NY. This asset was purchased from a group of 7 multi-generational trustees based out of the Northeast and serves as our 8th acquisition in Upstate New York over the last 18 months. We now maintain 15% of our portfolio in the state of New York and 45% of our portfolio in the Northeast.

In May of 2022, I had the opportunity to work on the acquisition of a Rite Aid property located in Salisbury, MD.

After a hotter than expected inflation print for the month of May and a FOMC meeting set to occur this week, most of the coverage has been focused on Jay Powell and his intentions to alter interest rates. It is thought that the Fed will raise rates 50 bps, with economists from Jeffries and Barclays calling for a 75-bps hike, but occurring in conjunction with this is the Fed starting the reduction of their balance sheet.

As a result of the COVID-19 pandemic, the net lease medical office market has seen all-time highs in investor demand, transaction volume, and cap rate compression. In 2021, medical office transaction volumes topped $16 billion—the sector’s all-time highest. Previously, the medical office sector saw its best year in 2017 with $15.5 billion in transaction volume. With many retail tenants struggling to pay rent as a result of the pandemic, investors found a safe haven in medical office assets. The medical office sector established itself as an area in which investors could shield themselves from the three main concerns within the retail sector: the pandemic, a recession, and the Amazon Effect.

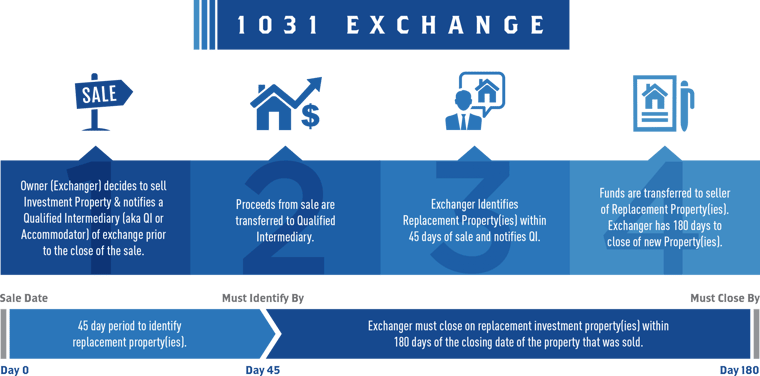

A 1031 Exchange is a Real Estate investing mechanism that allows investors to swap out one investment property for another, while simultaneously avoiding taxes on capital gains from the transaction. If used correctly, a 1031 exchange can improve an investor’s cash flows from long term investment properties.

It could well be a solution for those owning a low income producing, or Zero-Cash-Flow property, and swapping out for a higher income producing, or profitable one.

I recently had the opportunity to lead our acquisition of the SiteOne Landscape Supply anchored industrial facility located at 74991 Velie Way in Palm Desert, CA. This acquisition illustrates our strong desire for industrial properties as well as our openness to multi-tenant assets.

Considering the recent inflation levels, drugstore interest among investors has shown a decline. With Core Inflation Rates at 6.50%, the historically flat rents don't compute with the Consumer Price Index (CPI) of 287.71 points, making holding of Drugstore assets less secure of late.

In December of 2019, I had the opportunity to work on the acquisition of the Outback Steakhouse located on Stockdale Highway in Bakersfield, CA.