Fed Hikes Interest Rates, Commits to More Increases in 2022

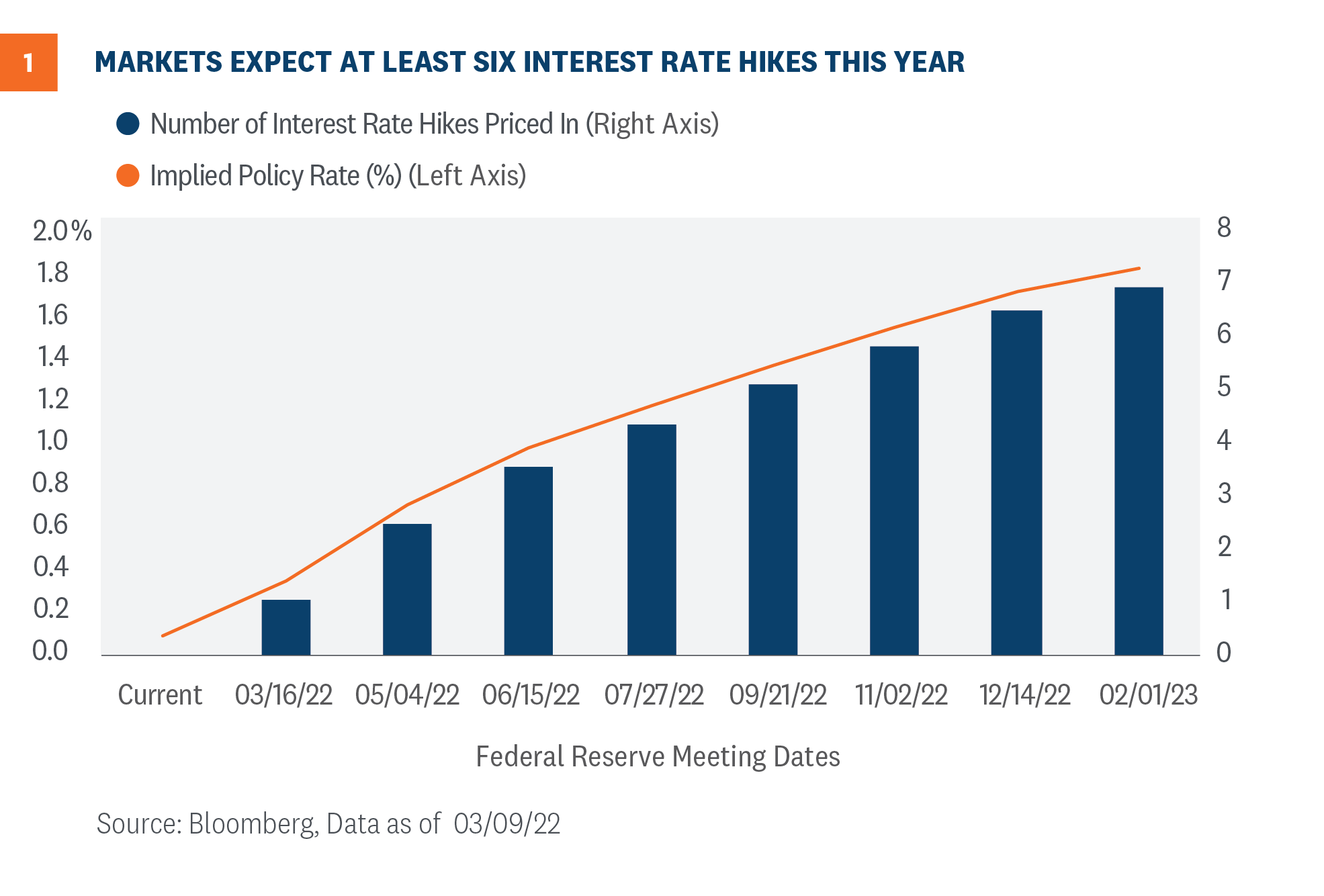

On Wednesday, March 16, the US Federal Reserve approved an interest rate increase of 0.25 percentage points, the first hike since December 2018. The Fed expects to raise rates at each of their six remaining meetings in 2022 with a consensus target rate of 1.9% by year’s end.

This is a full percentage point higher than what was indicated after the last meeting in December 2021. The Federal Open Market Committee (FOMC) says it expects to continue raising rates with three additional hikes to come in 2023. The only dissenting vote came from St. Louis Fed President, James Bullard, who favored a 0.50 percentage point increase.

Since December 2018, the Fed has targeted interest rates at 0.00% - 0.25%. The March meeting indicates a 175 basis point increase by year’s end, but it was close to being an even greater increase target. Of the 18 members on the FOMC, eight members expect more than seven total hikes in 2022, while the remaining ten consider seven total to be sufficient.

Historically, when interest rates rise, so do cap rates. This relationship can be attributed to traditional supply and demand metrics. As money becomes more expensive to borrow, there will be a lower supply of buyers in the market. This drives down demand for investments properties while the supply of properties either increases or sits relatively stagnant.

As interest rates are continuing to rise, we’re still aggressively closing on assets in the net-lease space. Please reach out to our senior acquisition associates for an updated purchase offer.

Connect with Zach Lesko: