The 1031 Exchange

A 1031 Exchange is a Real Estate investing mechanism that allows investors to swap out one investment property for another, while simultaneously avoiding taxes on capital gains from the transaction. If used correctly, a 1031 exchange can improve an investor’s cash flows from long term investment properties.

It could well be a solution for those owning a low income producing, or Zero-Cash-Flow property, and swapping out for a higher income producing, or profitable one.

What is a 1031 Exchange and Why is it Useful?

Section 1031 of the IRS’s tax code allows you to defer capital gains taxes when you sell an income producing property. Depending on your income bracket, the capital gains for properties owned for over a year are taxed between 15-20%. By entering a 1031 exchange, you can avoid paying this hefty tax by reinvesting the proceeds into a like-kind, income producing property.

One of the most common instances we see 1031 exchanges in the Net Lease space is when an owner wishes to sell out of management intensive properties:

-

For example, let’s say a landlord purchased a multifamily building in 1995 for $1,000,000 and consequently sold it in 2020 for $5,000,000.

-

The capital gains on this transaction would be $4,000,000 ($5m-$1m)

-

If they were to cash out, that $4,000,000 would be taxed by 15-20% which comes out to $600k-$800k in taxes paid on capital gains ($4m*0.15 = $600k).

-

However, said owner can defer these capital gains taxes by exchanging their proceeds into a net lease property. Now, instead of taking on large tax payments, the owner has avoided hefty taxes and reinvested their money into a less management-intensive asset.

In this example, instead of paying the $600k-$800k in capital gains taxes, they can put that now-additional money to work by reinvesting in an income producing property.

What kinds of properties qualify?

The technical qualification terms for properties that qualify for a 1031 exchange are as follows:

-

A 1031 exchange is reserved for property held for productive use in a trade or business or for investment. The investment must be held for 12 months.

-

The relinquished and the replacement properties must also be “like-kind”. The term “like-kind” refers to the nature or character of the property—all real property in the United States is “like-kind” to all other domestic real property, as in the IRC section 1031 of the IRS .

Examples of qualifying properties that could be exchanged:

-

Raw land or farmland for improved real estate

-

Oil & Gas royalties for a ranch

-

Fee Simple Interest in real estate for a 30-year leasehold, or a Tenant-in-Common interest in real estate

-

Residential, Commercial, Industrial, or Retail rental properties for any other real estate

-

Rental ski condo for a three-unit apartment building

What are your options and what is the timeline?

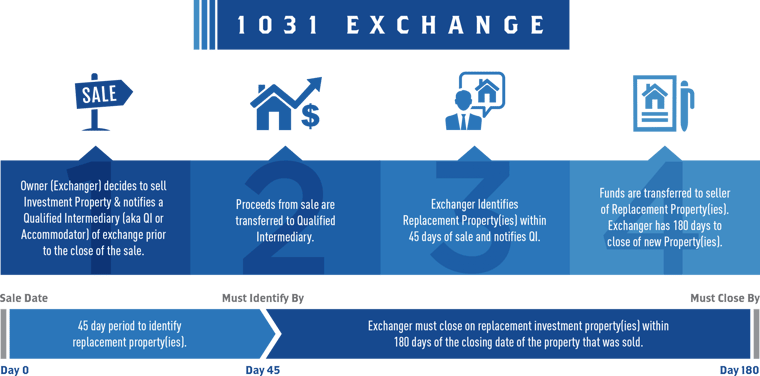

The IRS tailors the 1031 Exchange to a very specific and rigid timeline. As soon as the sold property (referred to as the down-leg) closes, a 45-Day identification period commences to select the replacement property (referred to as the up-leg). It is important to note that the owner does not have to be under contract on the properties he identifies. However, he must close on a certain number of those identified properties within 180 days of the sale of the down-leg by following one of 3 general rules:

-

3 Property Rule: Owner may identify up to 3 properties and can close on one, two or all three.

-

200% Rule: If the owner wants to identify more than 3 properties, they can use the 200% rule. In this instance, they can identify any number of properties as long as the aggregate fair market value does not exceed 200% of the down-leg.

-

95% Rule: The least common rule utilized in a 1031 exchange is the 95% rule. In this instance, the owner can identify more than 3 properties with an aggregate fair market value exceeding 200% of the down-leg, so long as they close on 95% of all identified properties.

The last instance where a property can qualify for identification is if the owner closes on the property within the 45-day period itself. In this instance, the property is considered formally identified and the above process does not have to take place. That is where Ocean Block Capital can improve a seller’s situation.

Where are the funds held between transactions?

Qualified Intermediaries, or QI’s, are an important role in the 1031 exchange:

-

A QI’s role is to ensure the exchanger remains in compliance with the IRS 1031 guidelines to help ensure the exchange is not disqualified.

-

The QI takes on 3 primary roles in the transaction:

-

-

Hold proceeds from the sale of the down-leg property in escrow. The exchanger is not permitted to hold these proceeds during the process.

-

Complete required documentation of the exchanger’s identification period to ensure it takes place within the 45-day window.

-

Transferring the funds to the exchanger’s title company/seller to purchase the replacement property.

-

-

-

QI’s are either institutional (subsidiaries of banks or title insurance companies) or non-institutional independents.

-

How can Ocean Block Capital accommodate?

As principal-to-principal investors, Ocean Block Capital can give you the unilateral right to extend the transaction closing period up to 60 – 90 days. This allows for more time to identify a property for your exchange. Often, 1031 exchange buyers will find themselves in a time crunch forcing them into a property that isn’t ideal for their situation to avoid the capital gains tax. By extending the closing period, we allow sellers to give themselves more time before that identification period begins. Because the rules state that a property is properly identified if it closes within the 45-day period, OBC can put you in a better position to meet that timeline.

Our team at Ocean Block Capital has extensive experience in meeting the needs of our sellers engaged in 1031 Exchanges, and are fully equipped with resources to meet the challenging and time-sensitive demands of the transaction.

Connect with Quinn Morris